Mixers vs ZeroLedger

How Mixers Work

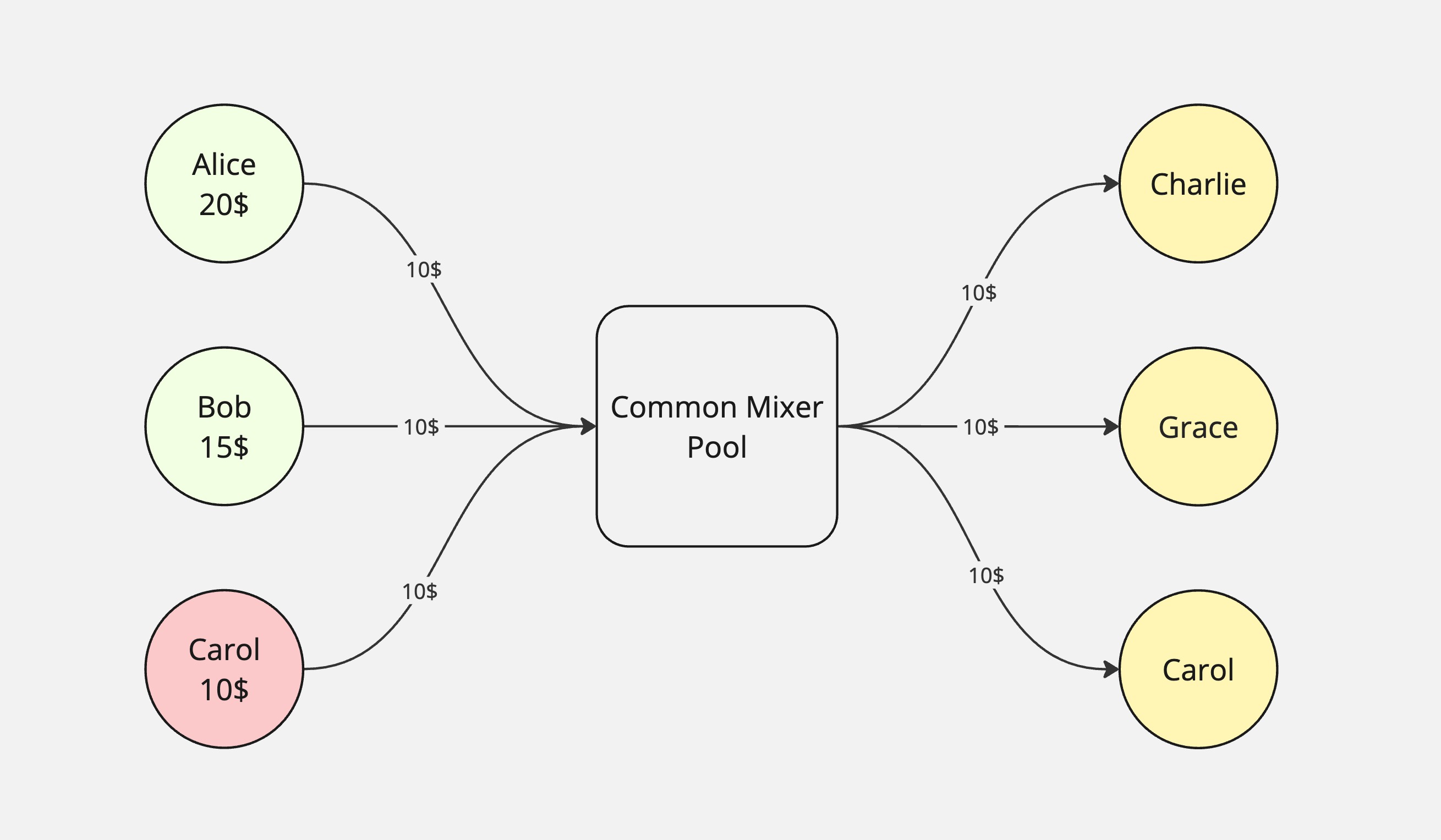

Traditional cryptocurrency mixers operate by pooling funds from multiple users and then redistributing them in a way that breaks the link between inputs and outputs. Here's how they typically function:

- Deposit Phase: Users send their tokens to a mixer contract with fixed denominations

- Mixing Phase: The mixer pools all deposits together, creating a large anonymity set

- Withdrawal Phase: Users can withdraw equivalent amounts after a delay period

- Anonymity: The larger the pool and the more participants, the better the privacy

The core principle is that by mixing funds with others, it becomes difficult to trace which specific inputs correspond to which outputs.

Mixer Limitations

While mixers provide privacy, they come with significant limitations that affect both security and compliance:

All-or-Nothing Risk Model

- Shared Risk: All balances are mixed together, meaning even one malicious actor increases risk for everyone

- Contamination: If any participant's funds are flagged or seized, it affects the entire pool

- No Isolation: Users cannot avoid mixing with potentially problematic funds

Complex Compliance Challenges

- No Transaction Traceability: Impossible to prove the source or destination of specific funds

- Regulatory Hurdles: Difficult to demonstrate legitimate use cases to authorities

- Audit Trail Gaps: No way to provide selective transparency for compliance purposes

- Travel Rule Compliance: Cannot identify counterparties for regulatory reporting

Operational Constraints

- Fixed Denominations: Usually requires predetermined amounts, limiting flexibility

- Mandatory Delays: Time delays between deposit and withdrawal to prevent timing analysis

- Liquidity Requirements: Needs constant participation to maintain effective mixing

- Risk vs. Privacy Trade-off: More participants improve privacy but increase contamination risk

How ZeroLedger Private Transfers Work

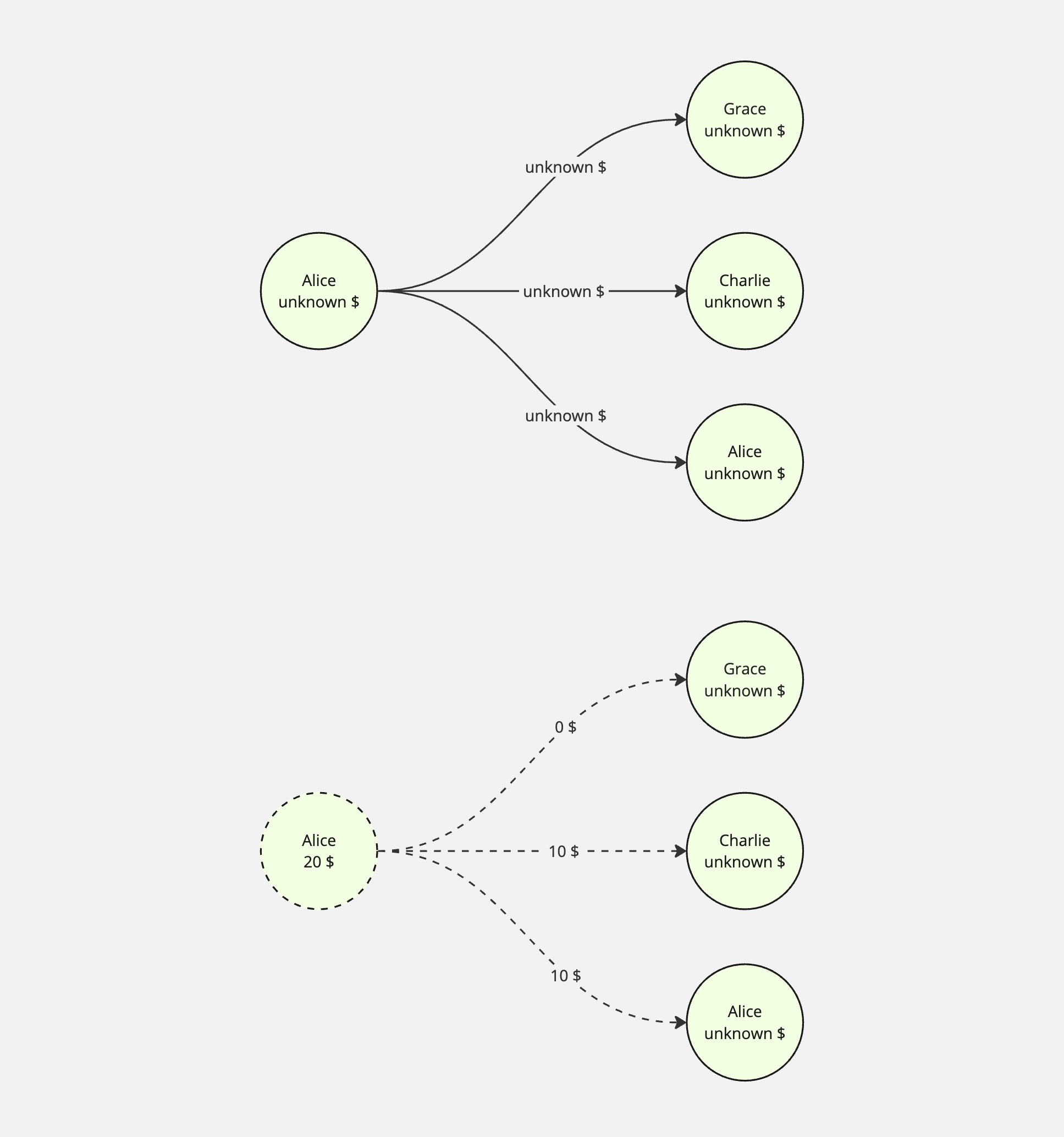

ZeroLedger operates fundamentally differently from mixers. It relies on confidential transfers to selected recipients and strategically managed decoy addresses.

Individual Privacy Pools

- No Shared Funds: Each user maintains their own private balance

- Selective Participation: Users choose decoy addresses for transactions

- Isolated Risk: Your funds are never mixed with others, eliminating contamination risk

Compliance Benefits

- Selective Disclosure: Reveal only specific transaction details when required by law

- Source Verification: All transactions are traceable, with real recipients hidden among decoys

- Audit Trail: Blockchain maintains complete transaction history by default

- Travel Rule Support: Identify counterparties when required by law

- Selective Funds Usage: Avoid spending funds received from non-compliant actors

Superior User Experience

- No Time Constraints: No delays for transfers within protocol

- Flexible Amounts: Send any amount without denomination restrictions

- Immediate Availability: Funds are available for use as soon as deposited

- Flexible Anonymity Sets: Privacy scales with your chosen interaction patterns

How Decoys Improve Privacy While Maintaining Compliance

ZeroLedger's decoy system provides a unique approach to hiding real money flow information while satisfying regulatory requirements:

- User-Controlled Decoys: You decide whom to interact with to create plausible transaction patterns

- Selective Interaction: Choose trusted parties for decoy activities to minimize risk

- No Contamination Risk: Decoys don't involve actual fund mixing

Privacy Benefits

- Plausible Deniability: Multiple possible transaction paths make it difficult to determine real flows

- Pattern Breaking: Transactions with decoy recipients break predictable spending patterns

- Anonymity Set Creation: Strategic decoys create effective anonymity sets

- Timing Obfuscation: Decoy activity masks real transaction timing

Key Advantages of ZeroLedger

| Aspect | Traditional Mixers | ZeroLedger |

|---|---|---|

| Fund Isolation | ❌ Shared pools | ✅ Individual balances |

| Compliance | ❌ No transaction traceability | ✅ Selective transparency |

| Risk Management | ❌ All-or-nothing contamination | ✅ Isolated risk |

| Flexibility | ❌ Fixed amounts & delays | ✅ Any amount, immediate use |

| Privacy | ✅ Good with many participants | ✅ Good with fewer participants |

| Regulatory Support | ❌ Difficult to audit | ✅ Full audit trail available |

ZeroLedger represents a paradigm shift from "mixing funds" to "mixing information" - providing privacy while maintaining the transparency needed for regulatory compliance. The following diagram summarizes privacy levels for different use cases: